Introduction

G$ is a reserve-backed ERC20 token housed on two different networks (aka Blockchains): Ethereum and Fuse. Because it is not currently listed on any centralized exchange (CEX) (e.g. Binance, Kraken, etc.), G$ can only be purchased via the GoodDollar protocol or from a decentralized exchange (DEX) operating on G$’s home blockchains.

DEXs (e.g. Uniswap, SushiSwap and FuseSwap) rely on protocols called automated market makers (AMMs) to keep trade flowing. These are smart contracts that allow blockchain users to provide liquidity in exchange for rewards. The assets these users provide are aggregated to smart contracts called liquidity pools, which are available for users who want to buy or sell tokens on the DEX. The deeper a given liquidity pool, the greater the chance an investor can safely and quickly complete a trade at or close to a token’s market price.

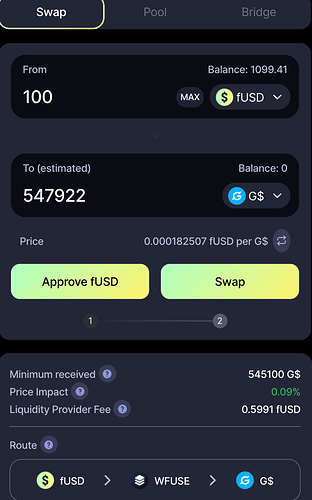

At present, the two major DEXs with aggregated G$ liquidity from LPs are:

- FuseSwap: ~400.000 USD in G$/FUSE pair

https://info.fuseswap.com/pair/0x8d441c2ff54c015a1be22ad88e5d42efbec6c7ef

https://info.fuseswap.com/pair/0x8d441c2ff54c015a1be22ad88e5d42efbec6c7ef

- SushiSwap: ~14.000 USD in G$/wETH pair

https://analytics.sushi.com/pairs/0x1dc9e3bb8b0700ce29d1615fbb62daa78c6ac427

https://analytics.sushi.com/pairs/0x1dc9e3bb8b0700ce29d1615fbb62daa78c6ac427

Larger DEXs with liquidity pools support trading in many cryptocurrency pairs, which are always distributed (in value) in a 50%/50% basis. As a result, when demand rises for a given token relative to its total liquidity, a trade may become more difficult or costly to execute. If you want to take a deeper dive into the mechanics of these AMM-equipped DEXs, this is a good article.

The GoodReserve AMM

G$ has its own AMM: The GoodReserve Market, which is embedded in the GoodDollarV2 protocol. The GoodReserve Market is a smart contract overlaid on the Ethereum network that is governed by a modified version of the Bancor Formula. The formula stipulates that the price of the G$ token moves in proportion to the aggregated value in the reserve (i.e. the pool of liquidity that supports G$) and in inverse proportion to the circulating total supply.

-

AMM on G$ price and issuance Policies

GoodReserve market is a fork from the Bancor Formula, a bonding curve which sets G$ price as a variable depending on the relation between the money in the reserve and the circulating supply of G$s:

$P=R/(r*S)$

Where:

$P = G$\ Price$

$R= Value\ in\ Reserve$

$S = Total\ Circulating\ Supply$

$r= Reserve\ Ratio$*Reserve Ratio is a protocol governed variable ($Value\ in\ Reserve/G$\ MarketCap$ ). The lower $r$ is, the more efficient is the G$ liquidity aggregation (G$ price can increase faster) but the token might be more volatile and subjected to dumps if there’s not real utility that sustain the demand.

There are three functions that modify the states of the above variables

- Conversion is the process that enables users to exchange G$ for cDAI (reserve asset) and vice versa, it does not impact the Reserve Ratio. The amount of G$ minted or burned depends upon how much collateral is added or removed from the reserve. Users who buy G$ receive a matching number of G$X tokens as a reward for their purchases, which can be used to reduce their exit contributions when they choose to sell G$ (the protocol keeps 3% of selling-G$s transactions if the user does not have the correspondent amount of G$X).

To maintain protocol value stability and to project a proper sustainable growth while building real token utility, $r$ was originally set to 1, while it has two functions that makes it decrease:

-

Expansion is the pre-set annual rate by which the token supply increases, thereby reducing the reserve ratio. For instance, the current expansion rate is set to 20% annually and the year begins with a reserve ratio of 1, then by the end of the first year the reserve ratio would be 0.8, by the end of year two, 0.64, and so on.

This function is called in average once per week (when yield from supporters is collected from the trustfund, but we are not going into those details here), so expansion rate at the moment of expansion is calculated on those basis (e.g. $20%/54$ as per the 54 weeks of a year). Reducing $r$ results in minting new G$ supply and distribute it in the UBI scheme. - Rewards Minting by the GoodDAO decision to incentivize liquidity aggregation over the Trust Fund or (possible in future) over other secondary AMM’s liquidity pools. The decentralized governance can therefore to decide expanding the circulating supply by reducing the reserve ratio

To further understanding on the GoodReserve AMM dynamics please use simulator:

The GoodReserve Market enables a liquidity-on-demand service, where the circulating G$ supply varies depending on market demand, which is in turn driven by a variety of factors, particularly market opportunities and the growing utility and usage of the token.

GoodDollar/Fuse Liquidity Rewards Program is Now Live

AMMs and Their Ecosystems

Since Ethereum is at present the largest and most secure blockchain ecosystem, we have chosen to house the policies that govern issuance (i.e. minting and burning) within that network. This is a choice designed to promote the security and value creation in the GoodDollar economy.

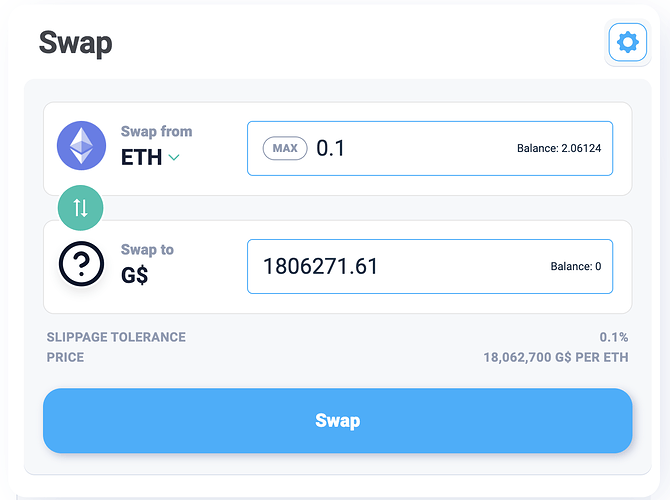

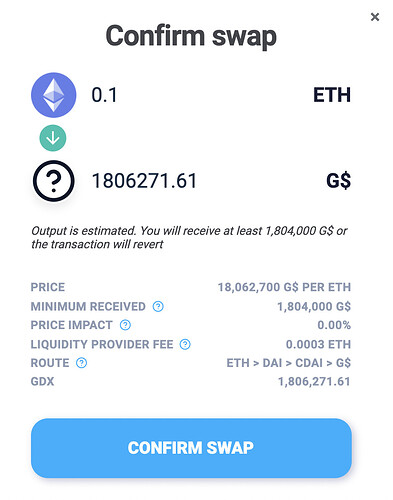

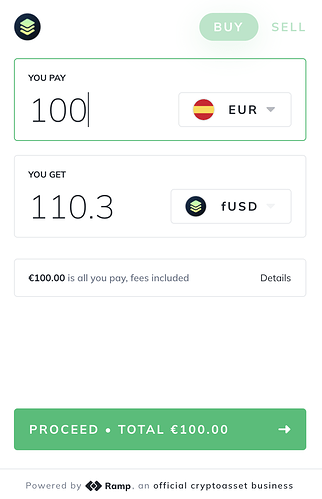

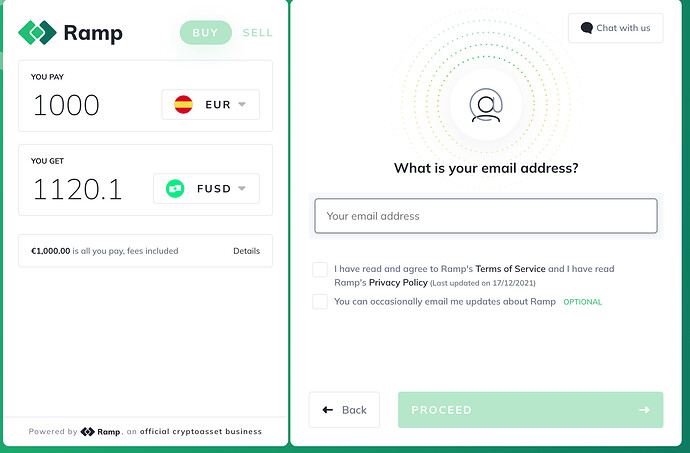

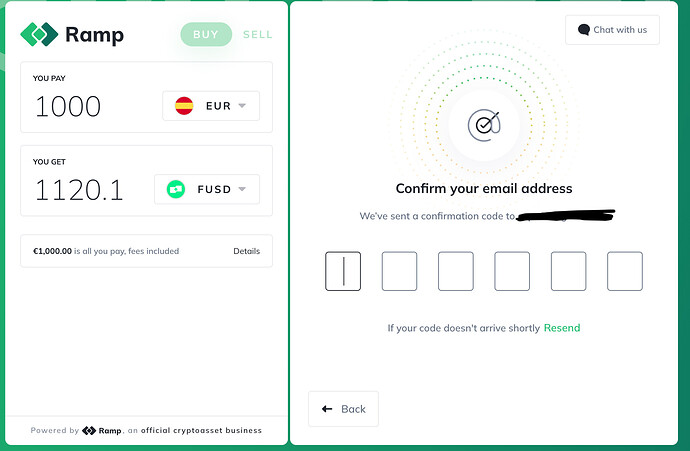

GoodSwap.xyz is the community-developed web app that GoodDollar community members can use to swap any token for G$s (and vice versa). Just connect your Metamask extension to Ethereum Mainnet network and you will be able to swap directly over this site.

After clicking on Swap, you’ll be asked to confirm the transaction via your Metamask. See below:

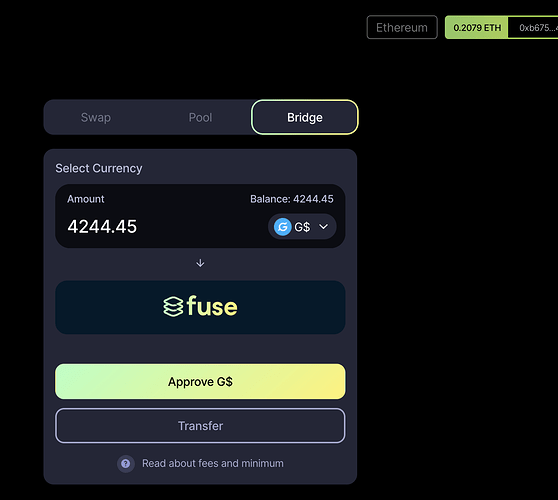

Liquidity Strategies & Using the Tools

Since Ethereum’s high transaction, or “gas”, fees can hamper the effectiveness of the liquidity we generate from the GoodReserve Market, we would recommend that users bridge their G$s to the Fuse Network, where GoodDollar’s UBI distribution and the bulk of G$ transactions take place. Here’s how to make that happen.

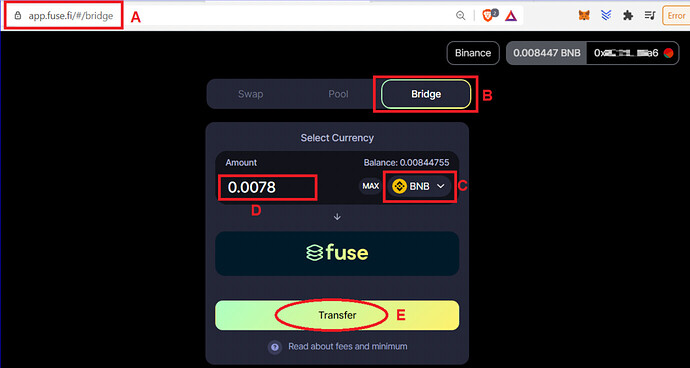

While connected to Ethereum network via your Metamask, go to https://app.fuse.fi/#/bridge and perform the bridging action:

Once transferred to Fuse Network, there are lots of ways to use your G$ to learn and to earn. Here just are a few:

- Add Liquidity to the G$/FUSE pair (or any other pair) to earn fees and gain exposure to other tokens.

- Deposit your Liquidity Pool Token (or LPT) and gain farming rewards (campaign open until February 12th) .

GoodDollar/Fuse Liquidity Rewards Program is Now Live

- Swap your G$ for any other cryptocurrency and explore new branded lending markets over Fuse network

- Buy, sell and trade goods and services on the GoodDollar MarketPlace.

- Stake your G$ to earn GOOD governance tokens.

There’s a wealth of possibilities out there. And given the speed with which the GoodDollar ecosystem is expanding and the creativity of our community, it’s only a matter of time before even more new and exiting G$ features and uses come along.

We wish you every success doing well while you do good with GoodDollar!