Hi Community!

I’m Meri, an active contributor to GoodDollar Community and a member of the Good Labs team for the past 2 years. One key aspect of my role involves fostering community engagement and encouraging GoodDollar members to take a more active role in contributing to the DAO. I’m launching this post because I believe that right now is a crucial time to gather more feedback from community members on how the future of GoodDollar should look! Hoping to see great engagement and involvement here

[Community Feedback]: Protocol Redeployment Plan

TLDR:

- Member feedback on efficacy of the GoodDollar protocol to date and where it should go

- Member feedback on G$ liquidity, and networks

- Member feedback on using GoodDAO treasury to support a redeployment plan

Now, more than ever, it’s time for the GoodDAO community members to express their opinions, concerns and suggestions to shape the future of the GoodDollar protocol and GoodDollar token (G$) models. Your participation and involvement are critical to building GoodDollar into a protocol that is maintained by the and for its community of members.

The purpose of this post is to solicit ideas and gather feedback. It’s crucial to note that all protocol contract deployments will undergo the protocol upgrade process through the GoodDAO protocol governance process.

Following the GoodDollar Reserve exploit suffered this past December (details on this post), the GoodDollar Reserve was drained. This affected the protocol’s core liquidity on both Mainnet and side-chains, influencing the price of G$. Currently, the GoodDollar Reserve contract is paused and there is low liquidity of G$ in the markets.

The vision for GoodDollar has always been a community run and governed protocol that serves the needs of its members. In every crisis there is an opportunity - and these circumstances provide a unique opportunity to reimagine and enhance GoodDollar. Your responsibility as a community member is to proactively influence how you believe GoodDollar ought to move forward. Your valuable inputs are crucial to reshaping the future of GoodDollar, together.

GoodDollar Protocol to Date

Before diving into the matter further, let’s briefly revisit the GoodDollar protocol vision and fundamentals:

As outlined in the original 2020 whitepaper, GoodDollar’s mission is to provide a sustainable, decentralized model to distribute Universal Basic Income in an open model. As mentioned in the whitepaper, “the GoodDollar protocol presents a community-driven, distributed framework designed to generate, fund and distribute global basic income via the GoodDollar token (G$). To achieve this mission, the GoodDollar protocol operates on a reserve model, where the GoodDollar reserve functions as the primary market maker for the protocol, and is a key part of ensuring sustainability, stability and liquidity of the G$ token.

Since the launch of the GoodDollar protocol in September 2020:

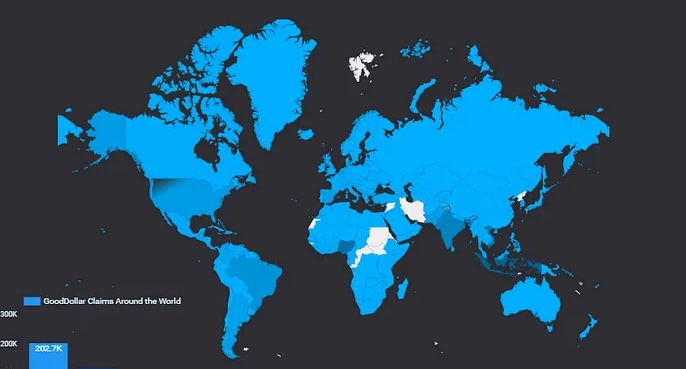

- GoodDollar has delivered G$ UBI to over 650,000 people across 181+ countries and territories

The Reserve protocol model has empowered GoodDollar to distribute more value in the Ecosystem than the funds directly held by the GoodDollar Reserve. A key aspect of this mechanism lies in the ability to mint money according to the Reserve Ratio, enabling a more extensive circulation of value within the GoodDollar Ecosystem than the actual value present in the collateral held in the GoodDollar Reserve. It’s important to note that there was no pre-mint of GoodDollar; only new cDAI deposits into the GoodDollar Reserve trigger the minting of G$, meaning that the entire G$ supply comes from the GoodDollar Reserve minting mechanism. This means that all G$ issued from the Reserve have a benefit on the GoodDollar ecosystem in various ways. Beyond direct UBI distribution, this may include minting G$ to fund liquidity and market making, invite campaigns, incentives and rewards, partner support initiatives, community initiatives, community payments, savings funds, and more.

How does the GoodDollar Reserve model support the G$ token model?

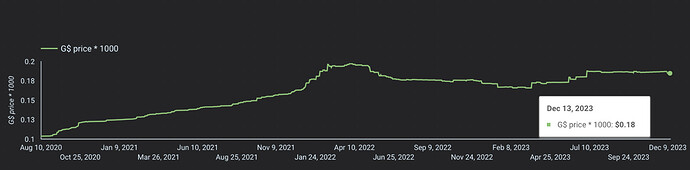

The G$ is a reserve-backed token designed to operate under three principles: sustainability, stability, and liquidity. The GoodDollar reserve has successfully worked to create a predictable token model from launch to date based on these three principles.

-

This model is distinct from the volatility of other crypto projects and token models. The GoodDollar Reserve has demonstrated remarkable success in maintaining a stable and consistently growing price across various market conditions, including both bear and bull markets.

-

Value predictability: The G$ token was launched at 1 G$ = 0.0001 USD and over its 3-years in the market until 12/16/23, the average G$ 0.00018 USD per token.

-

The value predictability has fostered an environment that encourages peer-to-peer usage, transactions, and the establishment of businesses centered around GoodDollar

- Assuming a price of 1 G$ = $.00018 USD, the value in transactions $6,259,634.30 surpassed the value of G$ UBI delivered (UBI = $573,381.85) by a multiplier effect of 10.91x

-

The stability of G$, as a reserve-backed token, has been instrumental in fostering price stability on side-chains decentralized exchanges (DEX)

-

The Reserve also created a vulnerability for the protocol per the exploit on 12/16/24, explained here.

Time to share your ideas and feedback

Now taking this context into consideration, all members of the GoodDAO have a say in exploring how GoodDollar should work moving forward, and contributing to an action plan. YOU are a part of this community and can choose to voice how you would like GoodDollar to move forward.

Contribute your feedback through this questions:

-

G$ Value

- How do you view G$ value?

- How is the G$ value linked to your goals?

-

Liquidity Deployment

- What networks are of greatest interest for G$ liquidity? Ethereum, Celo or Fuse?

- How is G$ liquidity linked to your goals?

-

GoodDollar Reserve - Network

- Does it make sense to continue to keep the core Reserve on Ethereum?

- What are your responses to the idea of moving the GoodDollar Reserve to another network (not Ethereum mainnet)?

-

GoodDAO Treasury Funds

The GoodDAO is the governance protocol that governs the GoodDollar protocol, and empowers community members to take an active role in determining its future: shaping GoodDollar’s destiny as it seeks to create free money as a public good for all.

The GoodDAO control the core protocol contracts as per GIP 2. The GoodDAO also holds various treasury assets, both funds donated from Good Labs Foundation and other sponsors, as well as protocol-ecosystem funds. The GoodDAO treasury holds various assets that could be used to support the re-deployment of the GoodDollar protocol and re-launch side-chain liquidity, per the GoodDAO.

GoodDAO Treasury Funds:

-

GoodDAO safes:

- Fuse address details for 0xCe69892CbDA078BbFAA3E5aE7A4b4d2Bf3E5c412 | Blockscout (Fuse)

- Contract 0x437C699887779D0A95aD6349CFDE7DFA716C005D - Celo Explorer (Celo)

- This includes allocated G$ funds from GoodDollar V3 upgrade

-

FuseStakingContract (Validator): Fuse address details for 0xA199F0C353E25AdF022378B0c208D600f39a6505 | Blockscout

- FUSE could be sold

*Validators are running special software that holds a copy of the Fuse Blockchain and validates transactions in the network, by doing that receives awards in the form of Fuse tokens (FUSE).

Share your perspective on how these funds should be used as part of a larger Reserve re-launch plan, that includes funding the reserve and funding side-chain liquidity.

Is there any additional feedback or suggestions you would like to share at this time? What aspects of GoodDollar do you find most valuable in its mission to deliver Universal Basic Income?

Your collaboration and input is valued to re-shaping the protocol!